TL;DR

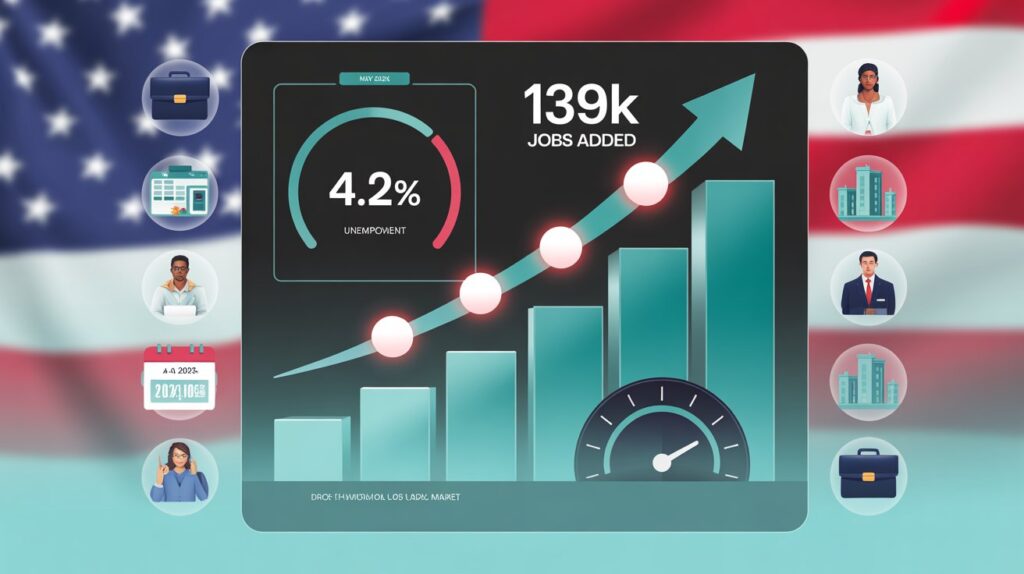

- 139,000 nonfarm payrolls added in May (+9 k above expectations)

- Unemployment rate remained steady at 4.2%, matching forecasts

- Average hourly earnings rose 0.4%, pressuring Fed rate-cut bets

The U.S. job market continued its gradual cooldown in May, adding 139,000 jobs—a slight beat over the 126,000 forecast—while unemployment remained steady at 4.2%. Wage growth and bond yields remained elevated, dimming near-term rate-cut hopes.

Slower Hiring, Steady Unemployment

According to the Bureau of Labor Statistics, nonfarm payrolls rose by 139,000 in May, a modest slowdown from April’s revised 147,000. Economists surveyed by Reuters had projected a 130,000 increase, placing May’s numbers just above consensus. The unemployment rate held at 4.2%, unchanged for the third consecutive month.

Job Markets Under Pressure

Hiring in May reflected broader economic headwinds. Trade policy uncertainty, including ongoing tariff shifts, appears to have dampened employer confidence—though businesses are largely avoiding layoffs. The April and March payroll numbers were downgraded by a combined 95,000 jobs, underscoring a pattern of downward revisions.

Wage Growth Keeps Inflation at Bay

Average hourly earnings climbed 0.4% month-over-month and 3.9% year-over-year, slightly above expectations of 0.3% and 3.7%, respectively . The combination of persistent wage pressure and stable unemployment points to a labor market that remains tight—and potentially inflationary.

Market Reaction & Fed Prospects

Treasury yields were volatile after the jobs release: the 10-year yield dipped to 4.32% before surging to 4.44%, while Wall Street futures trimmed Fed rate-cut odds. According to the CME FedWatch Tool, odds of a July rate cut dropped from 30% to just 16%, with September cuts now seen at 65%.

Stock index futures rose modestly: Nasdaq (+0.8%) and S&P 500 (+0.75%) while bitcoin reacted favorably, climbing above $104,000 coindesk.com.

Key Labor Market Metrics

| Indicator | May Report |

| Jobs Added | 139,000 (+ vs. expected 126k) |

| Unemployment Rate | 4.2% (stable) |

| Wage Growth (MoM/YoY) | 0.1025641026 |

| Treasury Yield (10-yr) | 4.32% → 4.44% |

| July Fed Cut Odds | 16% (down from ~30%) |

| September Fed Cut Odds | 65% |

Economic Snapshot by Sector

Employment gains were primarily in health care (+62k), leisure & hospitality (+48k), and social assistance (+16k). Meanwhile, federal government employment declined by 22k, marking a continued retrenchment.

The labor force participation rate dipped to 62.4%, and long-term unemployment now constitutes 20% of the jobless population. These trends, coupled with job and wage gains, point to a resilient yet cautious labor backdrop.

Broader Implications for Fed Policy

Despite weaker economic data earlier in the week—such as slower ADP hiring and contracting ISM Services—May’s labor report undercuts expectations for a July rate cut. The Fed appears poised to hold rates steady through summer and may delay easing until around the September meeting.

However, the tight labor market suggests inflation remains on the radar, particularly if wage gains persist above trend.

Bottom Line

May’s jobs report signaled a labor market that’s slowing—but not collapsing. With payroll additions modest yet consistent, unemployment stable, and wages climbing, the data supports the case for a patient Federal Reserve. Markets have recalibrated, with Treasury yields and rate-cut probabilities shifting accordingly. Economic watchers will now focus on upcoming inflation data and the potential downward revisions to earlier payrolls.