TL;DR

- Latvian startup Handwave introduces a palm-recognition payment system targeting European retailers.

- Unlike Amazon One, Handwave focuses solely on third-party deployment and affordability.

- The company has signed a deal with Visa and raised $4.2M to expand across the EU and beyond.

- Early success in Europe may position Handwave for U.S. expansion amid rising biometric payment competition.

Palm Payment Technology Moves Beyond Big Tech

Contactless palm payment, once science fiction, has become reality thanks to platforms like Amazon One, which has processed over 8 million transactions. Despite its scale, Amazon’s technology is largely confined to its own outlets, including more than 500 Whole Foods Market stores and select third-party deployments in the U.S.

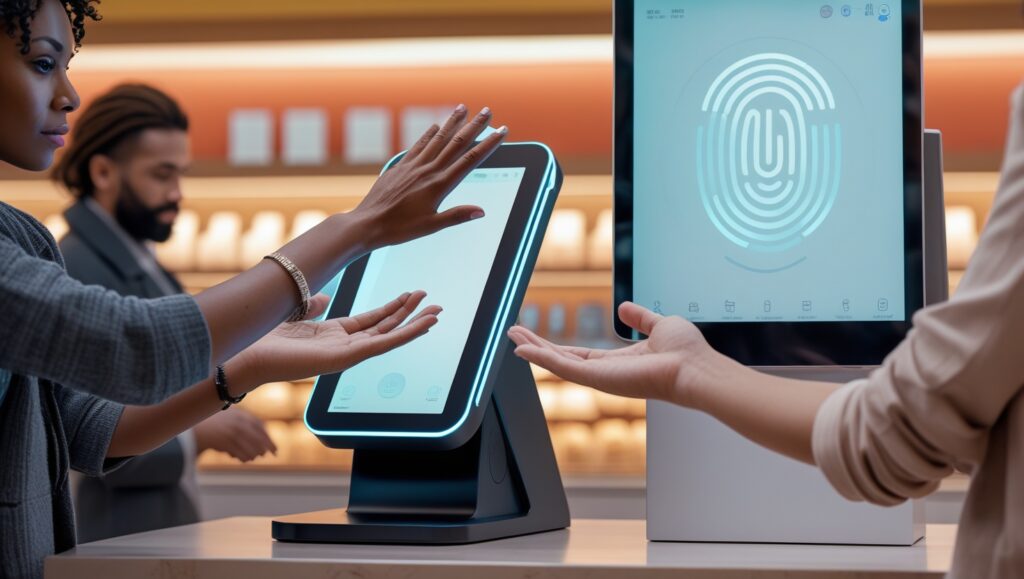

Now, fintech innovators like Handwave, based in Latvia, are seizing the opportunity to bring palm recognition to independent retailers. The startup is positioning itself as a nimble and cost-effective European alternative to Amazon’s offering, with clear advantages for smaller retailers seeking contactless, biometric checkout solutions.

Building an Independent Palm Payment Ecosystem

Unlike Amazon, Handwave doesn’t operate its own stores. Instead, it’s focusing on B2B partnerships. After three years of development, it now offers both proprietary hardware and software for palm scanning, tailored for third-party retail environments.

Co-founders Janis Stirna and Sandis Osmanis-Usmanis, both former executives at global payments giant Worldline, envision an open biometric platform. “Our plan is to collaborate with any financial institution or acquiring bank,” Stirna told TechCrunch.

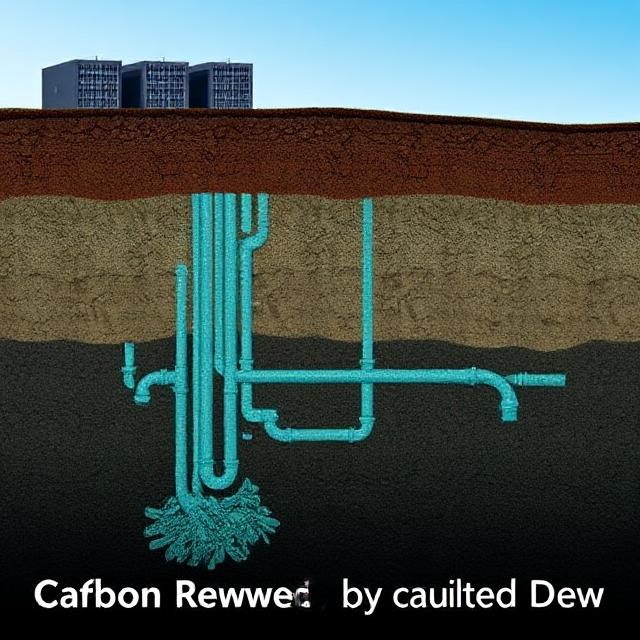

The palm recognition system doesn’t just scan surface-level features—it maps vein patterns, confirming the user’s physical presence to enhance security. This method is similar to how Apple Face ID operates but is optimized for palm biometrics.

Strategic Partnerships and Visa Integration

Handwave’s technology is already attracting interest from European banks. Although Stirna did not disclose names, he confirmed that several “very big” financial institutions are already on board.

In a major milestone, the company recently signed an agreement with Visa, which could streamline regulatory approvals and enable rapid deployment across multiple countries. According to Oskars Laksevics, Handwave’s Chief Revenue Officer, this partnership could be the linchpin for global scale.

Designed for Retail Efficiency

Merchants adopting Handwave will pay a transaction fee “on par or lower” than credit card processors, says the company. By reducing friction at checkout—no cards, apps, fingerprints, or facial scans—the platform promises faster, more secure transactions, even for age verification and loyalty programs.

This cost-efficiency, coupled with ease of use, could offer a competitive edge over traditional point-of-sale (POS) systems and biometrics-based rivals like Keyo, which also focus on secure access control and identity verification.

EU Compliance and Funding Advantages

Rather than launching in the U.S., Handwave is leveraging its European base to demonstrate GDPR-compliant security standards. As Laksevics put it: “It’s an advantage to start in the strictest market in the world.”

Developing in Riga, Latvia, also helped Handwave stay lean. It bootstrapped development using:

- A $780,000 angel investment

- $267,000 in EU-backed non-equity funding, including an EU cybersecurity grant

- Support from LIAA Business Incubator and Ready2Scale

The startup has now raised a $4.2 million seed round led by Practica Capital, with participation from Lithuanian funds FirstPick, Outlast Fund, and Inovo.vc of Poland.

Baltic Region: A Strategic Talent Pool

The Baltic States have become a magnet for fintech innovation. Handwave benefits from access to affordable, high-level AI engineering talent, a competitive advantage compared to Silicon Valley.

“There are not a lot of companies here that offer the kind of extreme technical challenges we’re solving,” Stirna noted, pointing to the region’s deep scientific and software talent base.

Looking to the U.S. and Beyond

Although its primary focus is Europe, Handwave has not ruled out a U.S. expansion. Should competitors like JPMorgan or Amazon One escalate third-party deployment, Handwave’s independent model and cost structure could be compelling differentiators.

The company’s ultimate goal is to become a global biometric payments platform, Laksevics said, adding: “I left a very well-paid corporate job to join this startup because I truly believe we’re building the next big thing in payments.”

🧠 Data Snapshot

| Metric | Details |

| Handwave launch year | 2022 |

| Palm transaction tech | Palm vein recognition (biometric + liveness detection) |

| Amazon One usage | Over 8 million transactions (source) |

| Seed funding | $4.2 million led by Practica Capital |

| R&D sources | $780K angel + $267K EU funds (Ready2Scale) |